Editor’s Note: The following analysis and editorial is presented by publisher Whitman Parker regarding a 5% Meals Tax proposal. Please note that he invited the proponents of this measure to answer questions numerous times, but they declined the opportunity. The Jacksonville Review believes that a meals tax is ill-advised and urges Jacksonville citizens to NOT to sign a petition to place this on the ballot. Thank you for joining me in supporting our family-owned restaurants and protecting their livelihood!

Background…How We Got Here—At the May 3 Jacksonville Budget Committee meeting, it was announced that a group of 3 Jacksonville citizens (Tom Gorman, Doug Phillips, Michael Sewitsky) hope to place a 5% meals tax measure on the November 2018 General Election ballot. The 5% sales tax is intended to help pay for a portion of Police Department funding and would be in effect for 10 years. To do so, they must collect approximately 400 signatures by August 10. The lead proponent of the measure, Doug Phillips, informed the Review that he is acting as the only spokesperson for the group.

Why a Meals Tax?—The meals tax concept was first introduced on 2/4/16 by Budget Committee member Doug Phillips, one of 7 citizens who serve alongside all 7 City Councilors. Neither the Budget Committee nor the City Council proposed the sales tax concept. During two years of discussion on ways to bolster the General Fund, a variety of funding ideas were discussed. Mr. Phillips did a detailed Power Point presentation of his meals tax idea on 9/8/16 to the Budget Committee and City Council that was thoroughly discussed and vetted. Ultimately, the Budget Committee and Council rejected the Phillips plan and recommended a $20 per/household surcharge fee in April 2018 to raise $400,000 a year for Police Department and General Fund purposes. The fee will appear on the water bill and is fixed for 5 years. The surcharge was later approved by Council in May 2018. The 2017/18 budgeted expenditure for the Police Department is $635,554, which is 40% of the General Fund. The PD budget consumes approximately 90% of property tax revenue collected. Please see the City Budget Letter below for more on how the additional $400,000 in funds is designed to strengthen city finances and pay for part of PD expenses at the same time. In my opinion, both the Budget Committee and Council have done a tremendous job with limited resources and are to be commended for steering Jacksonville on a responsible financial path.

Other Ideas to Raise Revenue Included:

- Annexation of property into the Urban Growth Boundary for more residential and commercial properties to increase property tax receipts.

- Increase the flat $3000/year fee paid by Pioneer Village for the Fire Department Surcharge.

- Charging a day use fee for the Jacksonville Woodlands hiking trail system.

- A City sales tax or property tax levy increase.

- Cut Fire Department shifts.

- Sell-off city owned land and buildings and charge market rents on buildings such as the Thrift Store, Art Presence Center and the historic church.

- Install parking meters in downtown.

- Cut city services and/or staff.

- Contract Police services to Jackson County and have our Fire Department annexed into Fire District #3. (FD3 rejected this plan.)

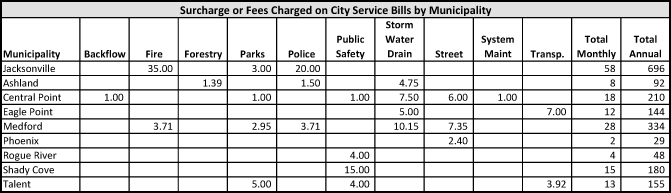

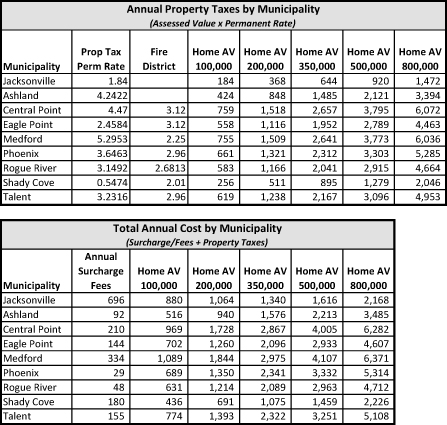

Another Surcharge?—The current $35 monthly surcharge is the only means of funding our 24/7 Fire Department. There’s also a $3 fee as a “Parks” fee for the care of city parks. Add in $20 for Police, and residents will pay $58/month per household for city services. If a meals sales tax is approved, the $20 PD surcharge will be eliminated. After exhaustive study, the Budget Committee and City Council decided against referring the matter to the voters, recognizing that a property tax measure would likely fail. In supporting the $20 fee, it was argued that all households pay equally for Police services, just as they do for Fire/EMS services, no matter the value of one’s home.

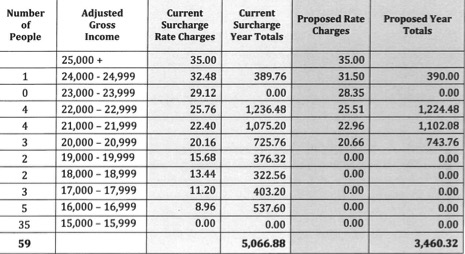

What if I Can’t Afford the Surcharge?—As with the Fire surcharge, the city will offer a relief program for the Police surcharge, outlined in the chart below. Applications are available online or at City Hall.

How Jacksonville Property Taxes & Fees Compare to Other Cities—As the charts below show, the cost of public safety surcharges and property taxes in Jacksonville are the second lowest in Jackson County. The charts also include other taxes/fees charged by cities, including separate fire tax districts, as well as other “city” related fees. Please consider the value of living in a city with 24/7 police and fire services and the positive influence these services have on our property values and quality of life.

Shifting Our Burden to Restaurants—To collect $400,000/year with a 5% meals tax, 14 restaurants must have sales in excess of $8,000,000 in food-only sales. (Alcoholic beverages are exempt.) The food tax applies to all prepared restaurant food, including coffee drinks, sodas, Ray’s Market deli sandwiches & ice cream cones, all fare sold at Britt Festivals, and more. In the Phillips initiative, restaurant operators may retain 5% of taxes for bookkeeping expenses while the City of Jacksonville can keep 2% for administrative costs. Therefore, food sales would need to be in the $8.5-9 million/year range. Of Jacksonville restaurants surveyed by the Review, all indicated that the cost of compliance and reporting would far exceed the money retained and in some cases would require hiring additional accounting services.

Show Me the Money, Mr. Phillips—Because Mr. Phillips wouldn’t meet with the Review, and cherry-picked audience questions at three town hall meetings, important questions remain unanswered. Most notably, where are the audited numbers proving that Jacksonville has $8-$9 million/year in food-only restaurant sales. I have concluded that his figures are a “guesstimate” of food sales. During presentations, he uses the number of tables in a Jacksonville restaurant and then simply assumes it turns over a certain number of times/day and that business is always steady. As an example, he assumes 25 seats x 2 table turns x $20 avg. meal cost x 350 days/year nets $17,500 in tax revenue. Without using actual, yearly restaurant receipts from an unbiased third party auditor, these projections can’t be taken seriously. Playing a guessing game to calculate tax receipts for public safety funding is bad math.

The Phillips plan also dictates that $50,000 in meals taxes collected in excess of $400,000 will be donated to the Jacksonville Historic Preservation Fund. While an admirable goal, this is simply playing politics and pulling on the heartstrings of certain voters.

Let’s Look at Ashland—In the state of Oregon, only Ashland and Yachats have a meals sales tax. In printed material and public presentations, Mr. Phillips uses Ashland, Oregon as his main comparison. He claims to have interviewed 6 restaurants for “data” collection and states that the restaurants didn’t object to having a 5% meals tax and that diners don’t object, either. Since he isn’t taking questions, I’m unable to say which 6 restaurants were interviewed. This is the antithesis of what the Review discovered. The Review discussed the matter with several long-time Ashland restaurateurs, who stated that the meals tax continues to deter Rogue Valley locals from dining in Ashland, years after its passage. Early on, the tax led to customer boycotts and created tremendous stress for the restaurant community, forcing some, including the GoodBean Ashland, to close their doors. Please view the numerous comments posted to the Jacksonville Review’s Facebook page and website from local residents who’ve posted, “If Jacksonville passes a meals tax, we will no longer dine in your town…don’t become Ashland…we don’t dine in Ashland because of their meals tax…”

With 166 restaurants, Ashland isn’t a good comparable to Jacksonville, with 14 family-operated restaurants. Jacksonville’s seasonal influx of visitors in June, July and August pales in comparison to Ashland, with a 9-month tourist season from February until late October, fed by the Oregon Shakespeare Festival. OSF sells 380,000 tickets to more than 100,000 unique attendees, 85%-90% of whom travel from outside the region and stay in Ashland for an average of three nights. These are not day trip visitors as is the case with Britt Festivals. In 2017, Britt Festivals sold 63,156 tickets, 80% of which were purchased by Rogue Valley residents. The population of Ashland is 22,000; Jacksonville is nearing 3000. Britt’s operating budget is approximately $3.5 million; OSF is $40 million. Telling voters that Jacksonville can fund its Police operations based upon Ashland numbers is fake news.

More Fees is Bad for Business—A meals tax will add insult to injury for overnight visitors who already pay a 9% Transient Lodging Tax fee, called a “bed tax.” Jacksonville allocates 50% of bed taxes to operate the Chamber of Commerce Visitor Information Center and 50% for grants to Jacksonville-based non-profits. Any reduction in bed taxes will negatively impact Chamber operations and non-profit groups applying for grants to fund their amazing work. An additional 5% meals sales tax will make Jacksonville less competitive, forcing visitors and diners to stay and eat in other nearby cities without a meals tax. If you don’t think it can happen, just ask an Ashland innkeeper or restaurateur who’s been around for a while. Increased taxes make for bad optics and perception is reality.

Restaurants: A Tough Business—Please consider that restaurants operate on extremely thin profit margins, some as low as 5%. If a meals sales tax drives away even a fraction of locals and visitors, the impact could be devastating, especially for a town with 14 family-operated restaurants. In the next three years, minimum wage in Oregon will increase three (3) times—placing even more stress on their bottom line. Restaurants are an unfair target of this sales tax.

Why Discriminate Against Restaurants?—A meals tax targets ONE segment of our businesses – the restaurants. Doing so is pure discrimination. If a sales tax is such a great revenue collection tool, Mr. Phillips should float a general sales tax initiative that targets all of Jacksonville’s merchants and service providers. Targeting one sector is unfair and blatantly discriminatory.

Police Calls—The tax proponents claim that visitors should pay their fair share for police services. In 2017, the Jacksonville Police Department responded to 2454 calls, of which 55 involved a restaurant, equaling less than 2% of calls. Considering that 70-80% of year-round diners are locals, visitors don’t eat up police time at all. Passing the cost of 24/7 police service onto visitors isn’t right…as a city, it’s our responsibility to pay for our public safety departments.

The “Un” Tax: Unpredictable, Unstable, Unfair—Not only does a meals tax unfairly target restaurants, collection of a meals tax is unstable and unpredictable. During the winter months, restaurant business declines and many restaurants operate at a loss for part of the year. This makes tax collection unstable and unreliable and makes city budgeting impossible. And winter isn’t the only time that business can suffer as evidenced by last summer’s smoke from wildfires that scorched Southern Oregon. Last July and August, dining receipts were down by as much as 50% at some restaurants, making collection of needed taxes impossible. Please consider the impact of collecting a meals tax should the Bella Union, GoodBean or Jacksonville Inn close its doors. If you don’t think that could ever happen, I suggest you ask the owners!

Bottom Line: A Meals Tax Bites—Mr. Phillips presented his ideas to the Budget Committee and City Council who weighed the pros & cons and then overwhelmingly chose another option. Because his plan wasn’t implemented, Mr. Phillips has now chosen to target the most fragile economic sector of the Jacksonville business community, placing our town at great risk. This is a risk none of us can afford to take.

Please join the Review in saying NO SALES TAX! And when a sales tax proponent asks you to sign a petition to place this ill-conceived idea on the ballot, tell them “No” and that a meals tax bites!

May 4, 2018

BUDGET MESSAGE

2018-2019

Welcome to the Budget Committee meetings for 2018-2019.

It is our privilege to present the proposed budget for the next fiscal year. As required by law, our budget for the upcoming fiscal year is balanced and it provides for the basic needs and requirements of the City.

This year’s preliminary budget meetings started with review of the financial analysis for all departments as well as the five year projections.

Salaries for all personnel are reflected in the budget per the bargaining agreement. The recent negotations with the Union settled at an increase of 2.2% as well as a few other changes including increasing the cash-outs of earned time off upon termination and also allows employees to cash out some earned time off one time per year. PERS rates increased in July 2017, which has been anticipated and in our three year projections; and are reflected in the budget. PERS will continue to increase.

Other notable changes are as follows:

General Fund:

We have continued to see an increase in building within the city, therefore related revenues will be increased in the 2018-19 budget. The Planning department is fully staffed and doing a great job under the leadership of our Planning Director, Ian Foster. We will continue to carry a budget item for Contract Services for Planning line item for RVCOG to continue as a resource, as we continue to work through the revisions to the Comprehensive Plan and Land Use Codes through the CCI.

As pointed out over the last few years, the Budget Committee has been working through funding options for the General fund. In December of 2017 the Budget Committee made a recommendation to City Council to implement a $20 surcharge per month to partially fund the Police Department. City Council voted to implement a Police Protection Surcharge on April 17, 2018 and approved the first reading of the Ordinance on May 1, 2018. The second reading and adoption of the Ordinance will go before City Council on May 15, 2018, with the surcharge taking effect and beginning on July 1, 2018. All of the resources and expenditures for the Police Department will be moved to a Police Protection Fund. $285,000 will be transferred in to the Police Protection Fund for the remainder of the funding. The General Fund is the only Fund within the City Budget that can support other Funds and the main source of revenue for the General Fund is property taxes. With over 90% of the property tax revenue funding just the Police Department, the General Fund has not been able to support other Funds within the City Budget. The implementation of the surcharge will enable the General Fund to begin building reserves and support the other Funds as it is designed to do with property tax revenue.

Police Protection Fund:

The Police Protection Fund will be established in the FY 2018-2019 budget. The Police Protection Surcharge will generate $400,000 and the General Fund will transfer in $285,000, which will pay for the operations of the Police Department at the same staffing and level of service for the citizens. There will be a Surcharge Relief Program put in place and City Staff will be publicizing the Relief Program to bring awareness to the citizens that there are options.

Fire Protection Fund:

The budget continues to reflect the $35 surcharge. While sustaining the fund it is not building capital for the future. The General Fund will transfer $50,000 to the Fire Protection Fund to begin building capital reserves. City Staff will be looking at the Surcharge Relief Program to see where we can assist citizens more and will be publicizing the Relief Program better to bring awareness to the citizens that there are options.

Cemetery Fund:

The survey and mapping work is still in process on the 11 acre parcel. The City will be doing some Cemetery restoration and the Cemetery gate is being replaced. The General Fund will transfer $10,000 to the Cemetery Fund to help with the overall needs of this Fund.

Street Fund:

The street fund remains in decent shape. We replaced one Public Works fleet vehicle and will be replacing the backhoe. The City will be doing some major street work over the next few years, therefore the General Fund will transfer $100,000 help with this street work. The City is also receiving two Small City Alottment grants in the amount of $50,000 each for Applegate Street and Shafer Lane.

Water Fund:

Per the ordinance in 2017, the base water rate will be increased by $1 each year, in July. We continue building capital in the reserves for the major projects identified in the Water Master Plan. The City has qualified for a loan from Safe Drinking Water Revolving Loan Fund in the amount of $2,600,000 at 1% interest, with $750,000 loan forgiveness, to work on some of the projects identified in the Water Master Plan. The payment on this loan will begin in FY 2020-2021 and will be $75,000 per year. Meter replacement has continued, to complete the radio meter read program. Additional projects will continue this next fiscal year based on their priorities.

Our Public Works Clerk will be retiring this year. We have hired a full-time Public Works Clerk and started the training for an easier transition June. We also have a part-time Utility Clerk, who works with customers on their bills.

Parks & Visitor Services Fund:

We will need to keep a close eye on the Parks Fund as it is slowly depleting as shown in the 5 year projections. The General Fund will transfer $75,000 to the Parks Fund to sustain this fund for a longer period of time.

SDC Fund:

SDC funds have been used for water lines and water rights; and the Main Street parking lot project has been completed. The SDC Fund is sustainable even after these capital projects.

Capital Project Fund:

This Fund will continue to be utilized for ongoing projects that have been designated, such as the elevator for the 2nd floor of the courthouse, which is still in progress. As you will see with the Urban Renewal tax increment revenue, we will be paying the loan off two years early in this fiscal year.

Urban Renewal Fund:

The tax increment revenues continue to build. We were able to make an additional payment on the Umpqua loan for Urban Renewal Projects in FY 2016-17 and in FY 2017-18, and as noted above, will be paying the loan off two years early this fiscal year. Now is the time to start looking at the projects listed in the Urban Renewal Plan to make a decision about potentially beginning another project.

With ongoing efforts this year’s budget continues to reflect how well City staff and Department Heads are doing to manage their prospective budgets.

We had some funding decisions to make in regards to future funding and worked diligently with the Budget Committee to address these issues over the past year. We have SUCCESSFULLY WORKED to put funding in place to keep a sustainable budget for many years.

Now let’s begin!

Whitman Parker is Owner and Publisher of Jacksonville Review and Southern Oregon Wine Scene magazines.

Whitman Parker is Owner and Publisher of Jacksonville Review and Southern Oregon Wine Scene magazines.

Agreed.

Relax Whit! This is just a petition to get the issue on the fall ballot. Democracy, ever heard of it?

There are two sides to every story and unfortunately, the one we see is incredibly biased by an overly opinionated Editor with an agenda of his own. Sadly, there is a growing number of people who feel that The Jacksonville Review Editor cannot be trusted. I believe Mr. Phillips, someone who I know to be honest and extremely devoted to this community, may have felt that, as so many in this town do, the Editor takes privilege with words and twists them to meet an agenda that is untrue. All this petition is for is to get this issue on the ballot. Should we really be bullied by an editor who picks and chooses what he wants to put in his “newspaper”? Advertisers beware, there are many residents who are throwing away their Whitpaper and hoping for a new advertising vehicle that trusts the reader to make his or her own choice. I, for one, do not need to be spoon fed how to think.

I may, or may not, vote for the restaurant tax. I need to do additional research and think for myself. What I do know is I want this option on the Fall ballot so that we, as a community, can decide for ourselves.

Thanks for this comment, Winfred Powers. Sorry to tell you but the tax proponents refused to answer important questions. Important questions that remain unanswered. Here’s one to ask them: if taxing the restaurants for public safety at 5% is such a great idea, why not a general sales tax at say 2% on every business? Here’s the deal: this tax is an attack on the restaurants by a member of the community with no real understanding of the consequences. Mr. Phillips had his hearing and his idea was rejected. Instead of taking the high road, he sunk and is now letting others do his bidding. Bring it on Winfred but beware: the readers got the truth from me, from the Budget Committee and from the City Council. The polling is clear: the meals tax is a bad idea. Oh and Winfred, feel free to write anytime with your questions or comments. Unlike Doug Phillips and friends, we’ll answer your questions!

Thank you for your response, Whit. Since you are willing to answer questions, here are a couple! Why are you not furious about the 9% tax on overnight lodging? If tax were such a deterrent, why are so many people investing in lodging cottages? Is it fair to pick on only this industry? When one writes a letter in favor of a mayoral candidate that isn’t your choice, will you run it next time? Many of us noticed the only candidates with glowing letters are the ones you support. When you assure someone that you will work together to improve access for people with special needs by writing about the ADA and the need for compliance in Jacksonville, will you follow through on what you promised? Your story of your amazing niece, unable to enter the stores or resteraunts in Jacksonville because of her disability was eyeopening. It seemed becoming ADA compliant was important to you 2 years ago. What happened? I don’t want to “bring it on”. I want to be respectful and have honest and enlightening conversations. The readers don’t get the truth from you, Whit, they get your opinion. Some may agree, and some may not, but your manner of tearing people apart who think differently than you is shameful.

Doug Phillips is just wanting to get his idea on the ballot. The “Hearing” you refer to is decided by a handful of people. A large group felt that it should be decided by the citizens of Jacksonville and Mr. Phillips followed the appropriate channels to achieve this on behalf of the community. This is what is called a Democracy. He, and many others, believe this is the right answer to the fiscal challenge that face Jacksonville but If it does not pass, Mr. Phillips will be fine because the people got to decide. This isn’t about you, Whit, and it is not about personally hurting a good, kind, intelligent and devoted Jacksonville resident. Mr. Phillips willingly chose not to be interviewed by you because your contempt for him is palpable and he knew your article would refelect such. I encourage anyone who has questions to call Mr. Phillips. He is more than happy to discuss this with anyone and, if one see’s this differently, Mr. Phillips will appreciate your listening and hope to become a friend. That is just who he is. I have been told that by writing this, I may cause trouble for myself and my family as you have tried to destroy people who publicly disagree with you. I respectfully hope that you accept this comment with the good intention that it is meant to have. Let the issue get on the Ballot and let the voters decide.

Hi Winfred, You asked a few questions above which I’ll answer now. How do you know my thoughts on a 9% lodging tax? I don’t recall having discussed it with anyone in the Review. Full disclosure: I sit on the city’s Bed Tax committee which uses the lodging taxes to run the Chamber of Commerce and provide grants to non-profits. In the last mayoral race, Mr. Becker received 8 times the number of support letters, most of which were not printed. His opponent received a proportional share of ink. On the ADA issue, as I told you in my office, I am a supporter of anything to increase access and when the city decides to do something about it via HARC, Planning Commission, Council, the issue will have my support. I am not the one to take this on but I will gladly print a letter on the matter. Yes, the readers get my opinion…a fact of life that 99% of them understand and accept. I have never hidden the fact that my opinion in in the ink. In terms of “bring it on,” this was in reference to your last letter wherein you suggested that my advertising clients should know people aren’t reading the publication – this smacks of irony. Whenever I print something “the other side” objects to, it seems as is everyone is reading the Review…how else would they read my point of view than by actually reading the Review? By the way, I should thank the petitioners as we now have several new restaurant and retail clients coming into the Review because they appreciate its pro-business stance. “Tearing people apart,” is hardly fair. Yes, Mr. Phillips is trying to get his idea on a ballot…I am trying to protect Jacksonville’s business community. Please let me know in any reference how I “tore” him apart…my op-ed was factual and respectful. And if you feel there’s a factual error, please let me know and I will address that, too. Other than saying “no'” to answering my questions and telling me there “are other methods of collecting data,” Mr. Phillips and I have never spoken…never. If you are under the impression I have contempt for him, you are wrong…I don’t know him. As a petitioner for a major issue, Mr. Phillips erred by avoiding an interview…assuming I have “contempt” for him and dodging questions and then complaining that his voice wasn’t heard is an illogical argument. I am pleased to have had the opportunity to answer your questions. Sincerely, Whit Parker, Publisher