On Money & More – May 2024

SPRING IS IN THE AIR, and this is a time when investors often say “Should I sell in May and go away?” There are always concerns bubbling to the surface for investors, but ultimately staying committed to your investment strategy has generally proven to be the most prudent strategy. This month we’d like to tackle some questions that our clients throughout the US have been asking us. If there are questions or topics you would like us to address in the Jacksonville Review, let us know!

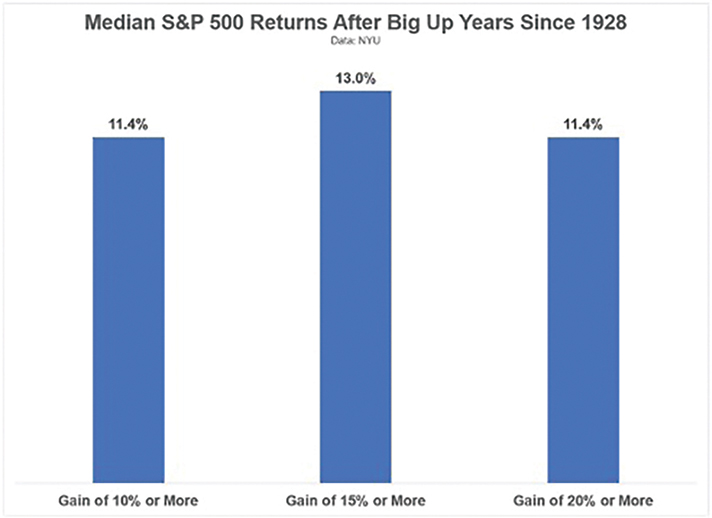

Market valuations are high, can stocks go higher?—By almost every measure, stocks are expensive relative to historical comparisons. The average forward P/E for S&P 500 stocks is 20.96x versus the 30-year average of 16.62x. But valuations can be a terrible market-timing device. Looking at the chart nearby (source: awealthofcommonsense.com), you can see that after big years in the market like 2023, investors often get another big year. We would advise people not to go chasing these returns, but instead to be diligent in a diversified portfolio built around their goals and risks.

Should I sell and hold cash until after the election?—Consumer sentiment in the US has become highly dependent on politics. The University of Michigan consumer sentiment survey has become increasingly representative of political views, less so of economic fundamentals—regardless of which party holds power in Washington DC. Now that Jackson County has a majority of voters registered as “unaffiliated” maybe we won’t be as tempted to cash out our retirement nest-egg based on party politics. The market would agree with this approach. A long-term chart of the S&P 500 has one dominant feature: It typically goes up! As a democracy, we have had frequent changes of political and policy regimes over the past century, and numerous eras of political division. Yet stocks have weathered each of these to be right near all-time highs today. Whatever your political leanings, this is an important point to consider. We view the stock market as a long-term forecast of economic strength, not a short-term yardstick of political approval.

What about global geopolitics?—Geopolitics can, however, have a outsized impact on the markets (although typically temporary). Oil prices in particular are subect to large swings from conflicts which are often based in oil-producing regions. 2022 saw a huge rally in oil prices after the Russian invasion of Ukraine. We have also seen an oil rally this year in concert with escalating tension in the Middle East. But these political energy shocks tend to be short-lived, and increases in price are typically followed by corresponding increases in supply that level pricing. While oil prices have rallied so far this year, these cycles can be self-correcting and patient investors should wait out the volatility. More concerning are long-term structural changes in the global economy. Deglobalisation, often in the form of onshoring, has the potential to put a floor under inflation. Many companies are looking to have a more secure supply chain, which means that the low-cost producing region (aka China of the past three decades) may no longer be the default choice. This may result in a medium term rate environment higher than the past, and your portfolio positioning should reflect this possibility. If you have questions about positioning your portfolio or how politics may impact your long-term returns, please reach out to any of us at Cutler, we are happy to help.

All opinions and data included in this commentary are as of April 15, 2024 and are subject to change without notice. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or individual investment advice including the asset allocation provided. Nothing herein should be construed as tax advice. This article is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase or sell securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Investing involves risk, including the potential loss of principle. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Leave A Comment