PLANNING FOR RETIREMENT: MEDICARE IS A KEY PIECE OF THE PUZZLE – by Erich & Matt Patten

On Money & More – April 2024

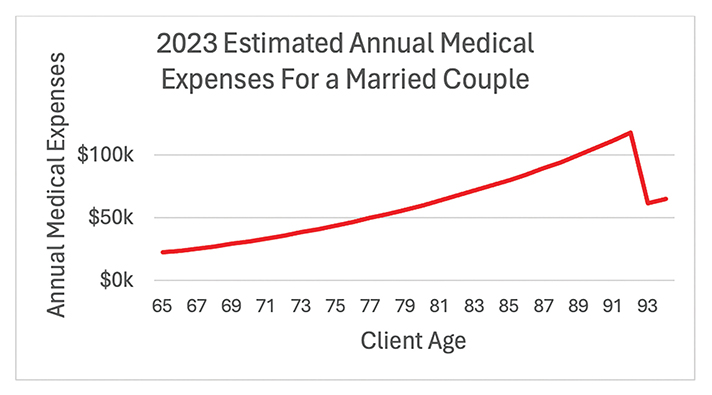

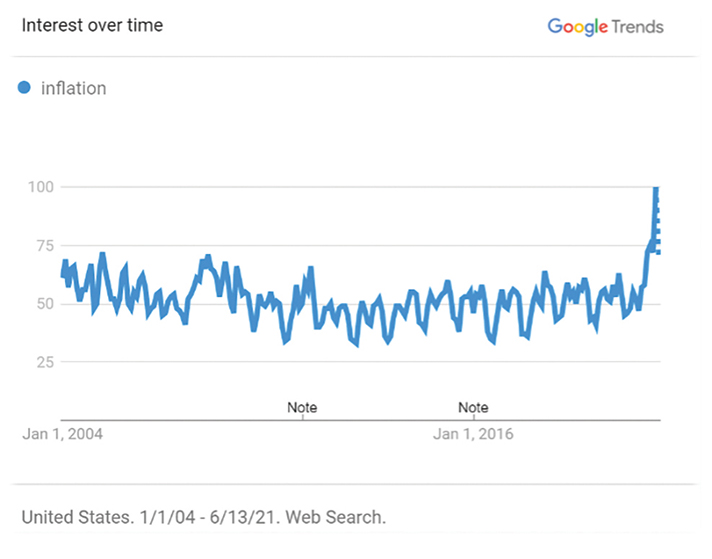

AS YOU THINK ABOUT planning your retirement expenses, Medicare plays an essential role. This US government healthcare plan, established in 1965, serves as the insurance plan for over 65 million Americans. Medicare can be very confusing, with significant penalties for missed deadlines. For those who have not yet signed […]

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.