On Money & More – March 2024

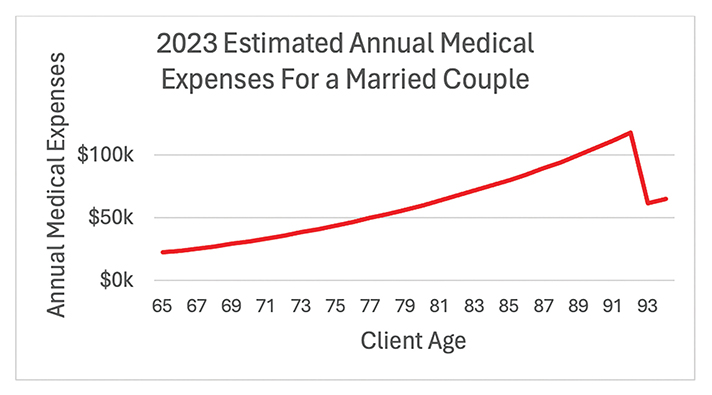

IF THERE IS ONE THING that keeps our clients up at night, it is the question, “What will my health care costs be in retirement?” Of course, the answer to this question depends on the health and longevity of each individual client, but we can use actuarial estimates to provide some guidance to this question. One such study is conducted annually by the actuarial firm, Milliman. Milliman’s projections combined with assumptions from Center for Medicare and Medicaid Services result in estimates shown in the chart. Source: Envestnet MoneyGuide (utilizing data from Milliman, Inc. and the Center for Medicare and Medicaid Serivces)

This chart shows that based on future cost and inflation expectations, a current 50-year-old married couple today could need between $800,000 and $1,400,000 (depending on their income) in retirement! That is quite an intimidating amount for most of us.

Given the substantial amount most of us will pay for medical expenses, a great savings vehicle that is often overlooked is a Health Savings Account (HSA). In fact, an argument can be made that an HSA is the most tax-advantaged account available to savers today. Why? Because only an HSA has the possibility for triple tax advantages: tax deductible on the way in, tax free growth, and tax free on the way out!

Now, not every expense is eligible to use with your HSA funds. In fact, only “qualified medical expenses” receive the tax benefits for withdrawals. What about non-qualified medical expenses? If you are under 65, these will be subject to ordinary income tax and a 20% penalty. But, after 65, these non-qualified expenses have no penalty. That’s the same tax treatment as a Traditional 401k/IRA!

While HSA’s are a great option for retirement savings, and an especially great one for paying those medical bills later in life, they aren’t for everyone. To be eligible, you need to participate in a high deductible insurance plan (as well as several other eligibility requirements). Also, if your employer has a company “match” in their retirement plan, this is likely a better option for your next dollar saved. But the HSA is a powerful account that can grow in tax advantaged ways. If you’d like to learn more, Cutler’s COO, Brook Anderson has posted a webinar to our website at cutler.com. Or, feel free to stop in at Bigham Knoll and ask us about whether saving in an HSA might be right for you.

All opinions and data included in this commentary are as of February 14, 2024 and are subject to change without notice. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or individual investment advice including the asset allocation provided. Nothing herein should be construed as tax advice. This article is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase or sell securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Investing involves risk, including the potential loss of principle. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.