On Money & More – March 2025

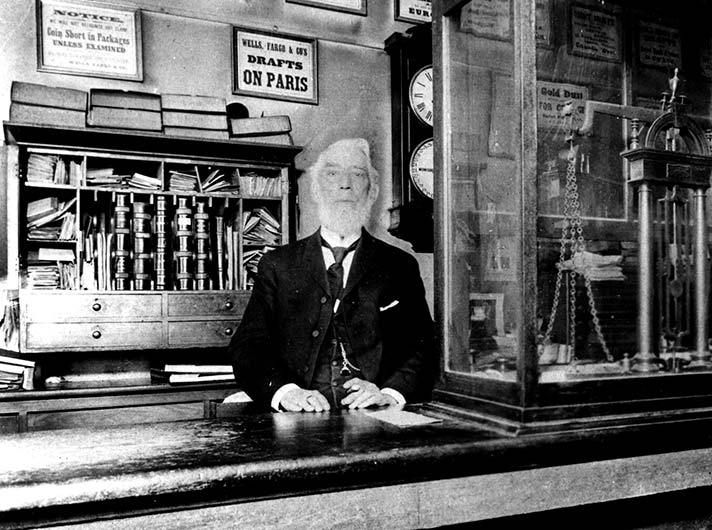

IN THE 1850s, Jacksonville was filled with miners hoping to strike it rich. Some did—but just as many lost everything. One man, profiled previously in the Jacksonville Review in a great series by Carolyn Kingsnorth, was Cornelius Beekman. Beekman built his fortune not on speculative gold dust, but instead on financial wisdom. Cornelius C. Beekman arrived in Jacksonville in 1853, transporting gold between Oregon and California. Seeing the need for a secure place to store wealth, he founded Beekman Bank. His bank gained a reputation as a conservatively managed business and helped him achieve success in building his wealth. What lessons can today’s Jacksonville residents learn from this pioneering founder of our small town? A quick look at Beekman’s approach to finance holds numerous valuable lessons that can be applied today.

What can we learn from Beekman’s success?

Protect What You’ve Earned—Unlike the miners who spent their earnings as quickly as they found them, Beekman built lasting wealth by avoiding risky speculation and investing in stable assets. We believe today’s retirees should do the same—maintain a well-diversified portfolio of dividend stocks, bonds, and real estate rather than chasing high-risk trends.

Keep Your Money Working—Beekman reinvested his wealth in business and real estate. Yes, investing requires risk, but Beekman’s approach is a model for growing your wealth. The long-term benefits of investing has benefitted generations of investors. In an environment where inflation is above historical averages, the costs for sitting on the sidelines can compound quickly.

Prepare for the Unexpected—Beekman’s bank survived economic downturns because he managed money cautiously. (As an example, instead of paying interest on deposits, he charged for storage.) Retirees should take a similar approach—maintain an emergency fund and avoid overexposure to volatile investments. Your investment portfolio should be rebalanced periodically, especially after several years of strong equity market gains.

Plan Your Legacy—Beekman’s wealth endured beyond his lifetime, and his contributions to Jacksonville remain today. Retirees should think about their own legacy with a clear estate plan, updated wills, and trusts to protect assets for future generations.

Cornelius Beekman didn’t gamble on luck—he built a legacy through financial discipline and smart investments. Today’s investors can do the same by protecting wealth, investing wisely, and planning for the future. As you walk past the historic Beekman Bank, consider what your financial legacy will be. With the right strategy, your wealth can endure—just like Beekman’s.

Sources: HistoricJacksonville.org, Jacksonville Review Cornelius Beekman Part 3, Carolyn Kingsnorth, August 2015. https://jacksonvillereview.com/cornelius-c-beekman-part-3-a-man-in-his-prime-by-carolyn-kingsnorth/

All opinions and data included in this commentary are as of February 11, 2025 and are subject to change without notice. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or individual investment advice including the asset allocation provided. Nothing herein should be construed as tax advice. This article is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase or sell securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Investing involves risk, including the potential loss of principle. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Featured image: C.C. Beekman at Beekman Bank

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.