Why does the City need money?

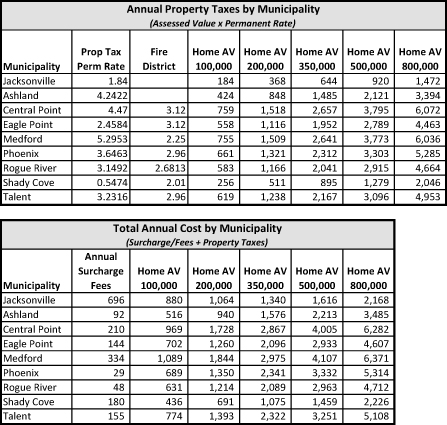

Under Measures 5 and 50, the City has the second lowest property tax rate in Jackson County-$1.84 per thousand assessed value. Because our police services are using up most of our property tax revenues, we need to find other ways of paying for our police protection without sacrificing other City services.

Can’t the City borrow money to pay for police?

No. The City can’t issue bonds to pay for services, only for capital improvements like streets or buildings.

Why not a property tax levy?

The Budget Committee considered it and finally rejected it. The tax would be levied unequally based on property values and would last only 5 years.

Didn’t the Council just take the easy way?

No. As required by state law, the Budget Committee and City Council considered the alternatives for nearly two years before the Council approved the surcharge.

Why not a meals tax?

The Budget Committee considered and rejected it. A meals tax would burden and threaten our tiny hospitality community. It would not produce consistent or sufficient revenue due to our short visitor season, economic downturns, weather and fire smoke.

Why the utility surcharge?

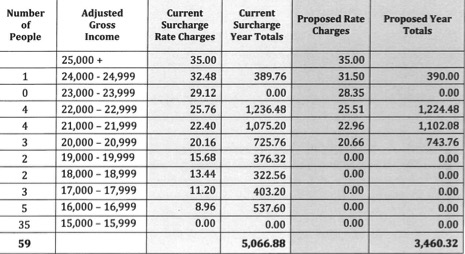

The Council approved the surcharge because it is a predictable and consistent source of revenue not reliant on County tax collections. It is apportioned fairly to all households and has a special relief program for low-income residents.

If I ask for relief, will my name be disclosed?

Absolutely not. Despite claims by some meal tax proponents, under state law, the names of relief recipients are completely confidential and cannot be disclosed.

Isn’t the surcharge just a tax?

No. In 2007, in the case of Knapp v. Jacksonville, the Oregon Supreme Court ruled that our City’s fire surcharge was a fee, not a property tax under Measures 5 and 50.

Won’t the surcharge be increased next year?

No. The surcharge is fixed for 5 years beginning in 2018 and cannot be increased during that time. This is the same period that applies to property tax levies. It can, however, be reduced or removed entirely if other reliable means of funding the Police Department develop.

Can’t the council use the surcharge for whatever it wants?

No. The surcharge goes into a special fund to be used only to pay for police services and nothing else.

Don’t other cities have meals taxes?

Out of 241 Oregon cities, only two heavily visited, much larger Ashland and tiny, isolated Yachats use meals taxes to pay for water treatment facilities, not public safety.

If the meals tax passes, will all the utility surcharges be gone?

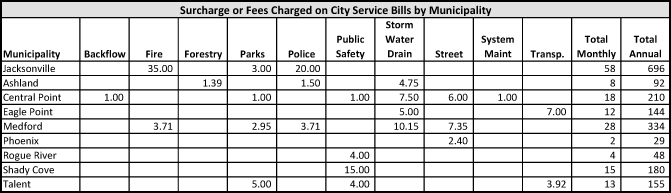

No, only the police surcharge of $20 will be repealed. The $35 surcharge for fire department will remain, despite the claims of some meals tax proponents.

Can’t the council change the meals tax?

No. The meals tax would be effective for 10 years, even if it does not raise enough money and can only be removed by public vote.

Won’t the meals tax raise enough money?

No. It is based on assumptions from Ashland with 166 restaurants versus our 14 restaurants. The Ashland visitor season is three times longer than Jacksonville’s.

What happens if the meals tax doesn’t raise enough money?

Police officers would be laid off indefinitely.

Picked up a hard copy of the paper when in Jacksonville the other day. What I found really useful but seems to be missing from the on line version is the charts outlining how various cities charge extra fees and taxes to their property owners. Please add in that cart so others can read it and share it with friends.

Hi Nina: Thank you for your feedback – those charts were reprinted from an article in the June 2018 issue – here is the link to that article that includes the charts – and we have added them here as well – thank you!

http://jacksonvillereview.com/no-meals-sales-tax-whitman-parker/