On Money & More – July 2021

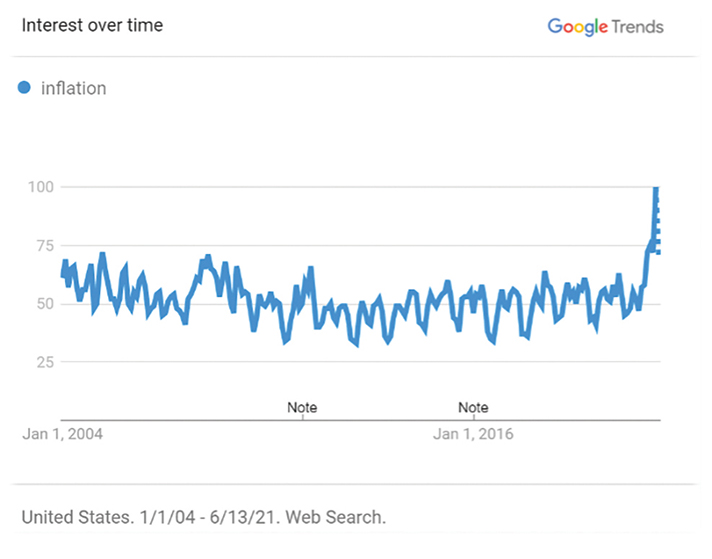

Inflation is on everyone’s mind these days. Looking at Google Trends data, May searches for “Inflation” reached the highest level since Google began tracking, nearly double the number of searches as recently as last fall. Should investors be scared of inflation? What should we be doing to position portfolios for a potential higher inflation regime?

First, let’s dig into the data. The Consumer Price Index1 rose 5% in May, which was the highest level since 2008. Everywhere we look, prices seem to be higher than last year. Used cars and trucks represented the biggest rise in the CPI, with prices up 7.3% for the month and 29% in the past year! Are you going on a trip? I’m sure someone has told you to book your rental car early as these prices are up 110% in the past year. Hotel prices are up 10%, and airlines are up 24% in the past year.2

Many of these price increases reflect a “re-opening” trade, as consumers rush to spend on amenities and experiences they went without during the pandemic. If you’ve been home with your kids for the past 18 months, there may be no price too high that you’re willing to pay for a change of scenery! Some price increases, such as those for cars, are a result of supply issues that producers will ultimately resolve. During the pandemic, car manufacturers dropped their semiconductor chip orders significantly. When demand for cars bounced back, chip manufacturers had already committed their capacity to other industries, which has created a global chip shortage for many industries. For many industries with very efficient supply-chains, recent price increases reflect the inability of production to catch up to demand.

The Federal Reserve, who is responsible for “price stability” in our economy has suggested that the factors outlined above are transitory. Thus, they have kept their foot on the gas, continuing quantitative easing (buying bonds on the open market) and keeping short-term rates at 0% despite strong economic growth. However, investors are worried something else beyond the “reopening” trade may be happening; namely, staggering amounts of government stimulus. During the Great Recession, the US experimented with stabilizing the economy using fiscal and monetary stimulus. The government spent about 4.9% of GDP to rehabilitate an economy that was on life-support. This has now become the crisis playbook, and the pandemic was met with an even greater response of 12.1% of GDP3! In the last fiscal year, the government spent $6.5 trillion of funds to help the economy recover. Inflation, if thought of as a monetary phenomenon, is too many dollars chasing too few goods. With all of this new money in the economy, there is a possibility of a higher baseline for inflation, which the Fed has targeted at 2%.

And investments have begun to reflect this possibility. Consider cash equivalents, which have yields near 0%. Or bonds, with the 10-year treasury having a rate for most of this year around 1.5%. With inflation running at mid-single digits, these investments are losing value each year. Stocks and real estate have been the beneficiary, as these investments have the ability for appreciation to keep up with inflation. But, with this appreciation has come an increase in risk as valuations are well above average. A sell-off in bonds (and thus higher rates) could make bonds much more attractive, but also could lead to an equity market correction. In such an environment, we would continue to favor equities, but would look for the lower risk and more attractive valuation portions of the equity markets.

1 The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

2 https://www.cnbc.com/2021/06/10/cpi-may-2021.html

3 https://www.mckinsey.com/featured-insights/coronavirus-leading-through-the-crisis/charting-the-path-to-the-next-normal/total-stimulus-for-the-covid-19-crisis-already-triple-that-for-the-entire-2008-09-recession

All opinions and data included in this commentary are as of June 14th, 2021 and are subject to change without notice. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or individual investment advice. This article is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase or sell securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Investing involves risk, including the potential loss of principle. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.

Matthew Patten is CEO and Investment Portfolio Manager at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Matt earned BA degrees in Economics and Environmental Geo-Sciences from Boston College and a MBA from the University of Chicago.

Erich Patten is President and Chief Investment Officer at Cutler Investment Group. He is a graduate of Jacksonville Elementary School and South Medford High School. Erich earned a BS in Economics from the Wharton School, University of Pennsylvania, and a Masters in Public Policy from the University of Chicago.