Let’s Talk Real Estate – July 2023

The housing market in the US and locally has been on an interesting journey, experiencing a large drop in demand, a limited supply of homes for sale, and a quick run-up of mortgage rates. The result has been somewhat predictable but not without a few major surprises.

Home Sales—The result of the Federal Reserve aggressively increasing the prime lending rate has resulted in mortgage rates increasing from 3% in the summer of 2021 to over 7% in summer 2023. This has resulted in home sales recording their second largest decline. The only decline which was more severe was in 2007/2008. However, the dynamics of the current market are completely different. In 2007/2008 the market was highly leveraged with speculators flipping homes and homeowners refinancing and pulling out all their equity, leading to extremely low equity rates. In today’s market we currently have the third highest equity rates recorded.

Home Prices—It’s been a surprise to see that home prices have declined less than expected in the face of increasing mortgage rates and falling demand. In Jackson County, pre-existing home sales decreased 3.1% at the end of May 2023 compared to May 2022. What’s interesting is home prices have increased over 87% since the end of the 2012 recession.

Prices have stayed high because the supply of homes for sale has stayed low. Homeowners are hesitant to sell their homes because they don’t want to lose their 3% mortgages and buy a new home with a 7% mortgage. Inventory is low, with less than 3 months’ supply for sale in Jackson County. With home prices staying high and mortgages rates over 7%, we do have a growing affordability challenge, keeping many out of the market.

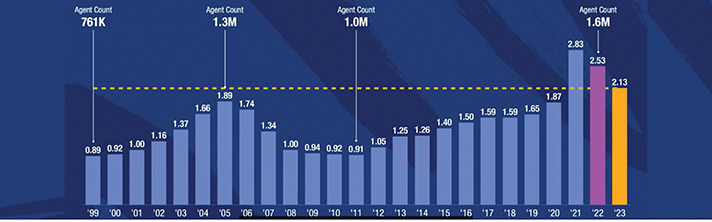

Total Market Volume—Another surprise is that 2023 is projected to have the 3rd highest Total Market Volume in recorded history (see chart above). Even though the number of homes selling has declined, the homes that are selling do so at prices only seen in the last two years. Real Estate sales will continue to be a major contributor to the U.S. economy, accounting for nearly 17% of the national GDP and we will have our 3rd best year recorded.

Rental Market—No surprises here. The rental market continues to be strong, and rents continue to climb. For decades there has been a shortage of rental homes and there seems to be no end in sight. Competition is high for a nice rental home; they will usually re-rent, sight unseen before the current tenants moved out. With less families qualifying to purchase a home, we see increasing demand for rental homes and families will have to rent longer, and at higher prices, before they are qualified to buy a home.

Short Term Rentals—Locally, the supply of short-term (month-to-month) furnished rentals exploded in numbers to accommodate all the families who lost their homes in Phoenix and Talent in the 2020 Almeda fire. At the beginning of 2023, we experienced an oversupply of short-term rentals in Southern Oregon, but that inventory is slowly decreasing. There is another concern for this market as traveling nurses and medical professionals make up a good portion of the tenants and Asante is now bringing in nurses from the Philippines on H-1B visa. This type of visa allows employers to employ foreign workers in specialty occupations that are hard to fill with the domestic labor pool.

Nightly Rentals—Another pleasant surprise is nightly rentals booked online continue to grow despite talk of an economic downturn. Nightly bookings on Airbnb, VRBO and other sites grew by 17% this January. Unfortunately, the supply of nightly rentals grew by 22%, so many owners are feeling the increased competition and they have less bookings than in previous years.

The housing market in the US has experienced a huge drop in demand, limited supply of homes for sale, and an increase in mortgage rates. Despite these challenges, the surprise has been home prices have declined less than expected due to low inventory. However, this has posed an affordability challenge for many potential buyers, with the combination of high prices and high mortgage costs. Despite the decline in the number of homes sold, 2023 is projected to have the third-highest total market volume in recorded history. The rental market remains strong, with increasing demand and rising rents. Short-term rentals saw an oversupply initially but are gradually decreasing, while nightly rentals booked online continue to grow, albeit with increased competition. Overall, home prices have remained relatively stable despite decreased demand, and economists predict a slight decrease in interest rates by the end of 2023.

Featured image: Total Market Volume for US Home Sales – 2023 predicted to be the 3rd largest