On Real Estate & More – October 2022

Although sales of existing homes in Jackson County only fell 1.8% overall for the year (per the Rogue Valley Association of Realtors), inventory of all homes on the market increased about 60% from this time last year and pending sales for the year have decreased by 5%—so it shows a continued slowdown in the market.

The year-to-date total number of existing homes sold in Jackson County was 2,549, compared to 2,595 during the same period in 2021. The county-wide median price for the year to date came in at $435,000, up 8.5% from last year’s $400,000. Homes sold at an average of 29 days on market, compared to last year’s 24 days.

Jacksonville statistics were quite different than the County in general. 14 homes sold in urban Jacksonville this quarter compared with 21 the same time last year. And the average number of days on the market increased to 53 from 27 days. The median price for the quarter came in at $582,500, which is 11.1% lower than the same time in 2021 of $655,000. The number of active listings as of August 31 increased to 21, up from five the same time last year

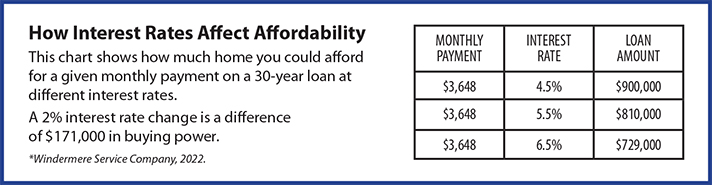

Interest rates play a significant role in determining your buying power, and ultimately, which homes you are able to afford. For every 1% increase in interest rates, your buying power decreases by 10%, and for every 1% decrease in interest rates, your buying power increases by 10%. As rates go up, the less home you’re able to afford. To get the most home for your money, you’ll want to get the lowest rate possible.

Inflation has been surging at its highest level in 40 years, and mortgage rates have already risen by roughly 2% since the beginning of this year. The Federal Reserve recently hiked interest rates by 75 basis points, and more increases are likely on the way. Combined with high home prices, many homebuyers are starting to feel like buying a home is becoming out of reach.

While news like this can feel discouraging, it’s important not to panic. The housing market is shifting. Since the beginning of the year, mortgage rates have moved up. Home prices are still increasing, just at a slower rate, and in some markets are starting to come down. These higher rates and prices have reduced the number of buyers, while sellers have more competition as more listings hit the market. With these developments, here are a few key points for sellers to consider:

There is a new reality in the housing market. The housing market is shifting to fewer buyers, more sellers, and slower price gains. This means they’re probably not going to see offers within a few days of listing, or multiple offers, or a sale price over asking.

This is not the end of the world. There still is an inventory shortage, and there are plenty of buyers who can afford a home at the new interest rates—it just might take a little longer to make the sale.

Price is critical. Now more than ever, it’s key to set the price correctly from the start. Homes are priced ahead of the market, so when price gains are slowing, the price must reflect that.

Home preparation is key. Having less competition, buyers can now afford to be picky. That means they choose the nicer homes first. Declutter, repair, upgrade, and clean.

Offer financial incentives only as a last resort. Be patient, as things are happening more slowly. Avoid being quick to give money away, but if you must, after a reasonable period, do a price reduction, or offer to buy down the buyer’s interest rate or provide a credit for closing costs.

Even in a changing market, if the property is priced realistically and looks appealing to buyers, it will sell!

Sandy J. Brown lives in Jacksonville and is a real estate broker and land use planner with Windermere Van Vleet Jacksonville. She can be reached at sandyjbrown@windermere.com or 831-588-8204.

Sandy J. Brown lives in Jacksonville and is a real estate broker and land use planner with Windermere Van Vleet Jacksonville. She can be reached at sandyjbrown@windermere.com or 831-588-8204.