My View – May 2023

Successful municipalities run on tight budgets…something our city staff and council have mastered due to our small tax base. At its April 13 Budget Committee meeting, staff presented their 3-year budget projections in advance of the first formal budget meeting on May 11. (If needed, follow-up meetings will be held on 5/18 and 5/25. The City Council has scheduled the formal Budget Hearing for June 6 during its meeting.) The Budget Committee, comprised of 6 citizen volunteers and the 7 council members, is preparing to take a deep dive into the budget, including the Police Fund. Like the Fire Department Fund, the Police Fund is not funded with property tax dollars, but by surcharges on our water bill.

Staff is expected to recommend increasing the Police surcharge from $20 to $25 a month beginning this July. Should operational costs increase as estimated, in July 2024, the Police surcharge may be upped another $10/month, to a total of $35, where it should hold for several years. Jacksonville enjoys the second-lowest property tax rate in Jackson County, which is a plus and a minus. If our homes were in Medford, Central Point or Ashland, property taxes would be significantly higher. Proponents of surcharges argue they are less costly than property taxes and can be lowered if warranted. Opponents argue that the surcharge is not tax-deductible for those itemizing on their tax returns.

No matter, staff noted challenges in hiring police officers and that it is exploring ALL options—including contracting with the Jackson County Sheriff’s Department to hire officers for nighttime-only shifts.

I encourage you to get involved and participate in the process and learn more about how and why these decisions are being made. Meeting times/dates are announced each month here in the Review and on the city website. Having placed much faith in our staff and City Council for nearly two-decades, I am again confident they will do what’s best for our Small Town with Big Atmosphere.

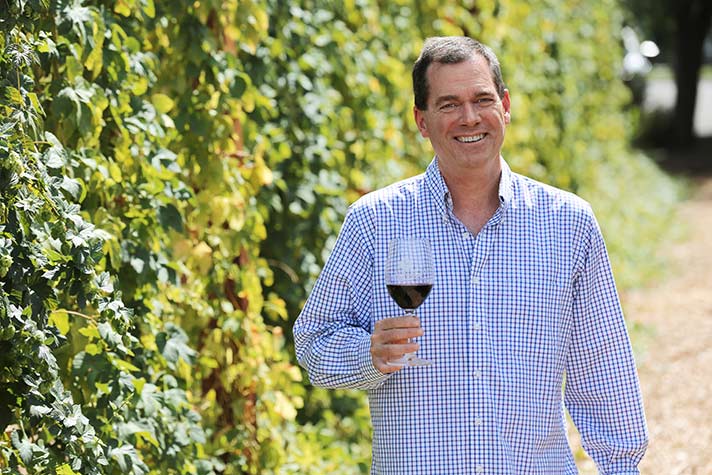

Whitman Parker is Owner and Publisher of Jacksonville Review and Southern Oregon Wine Scene magazines.

Whitman Parker is Owner and Publisher of Jacksonville Review and Southern Oregon Wine Scene magazines.