Let’s Talk Real Estate – by Graham Farran, Expert Properties

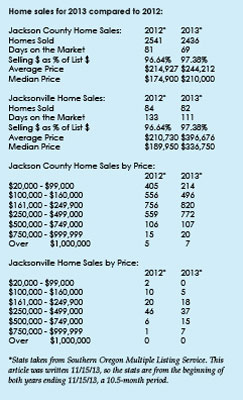

Jackson County has had an incredible year in the Real Estate Market. Home prices in most metropolitan areas of the United States grew significantly in 2013, with the national median price rising at its fastest annual rate in eight years. The good news is Jackson County has exceeded the national average with median price (meaning half the homes sold over this number and half sold under) of a home increasing by almost 20% in 2013*. This increase is due in part to home prices increasing and in part to the make-up of those homes that sold. For example, in Jacksonville the median price has increased by 77% mainly due to more than three times as many homes selling over $500,000 in 2013 than sold in 2012. All in all, 2013 marked the first year of significant recovery with double-digit growth and the return of the high-end housing market.

Jackson County has had an incredible year in the Real Estate Market. Home prices in most metropolitan areas of the United States grew significantly in 2013, with the national median price rising at its fastest annual rate in eight years. The good news is Jackson County has exceeded the national average with median price (meaning half the homes sold over this number and half sold under) of a home increasing by almost 20% in 2013*. This increase is due in part to home prices increasing and in part to the make-up of those homes that sold. For example, in Jacksonville the median price has increased by 77% mainly due to more than three times as many homes selling over $500,000 in 2013 than sold in 2012. All in all, 2013 marked the first year of significant recovery with double-digit growth and the return of the high-end housing market.

Bottom Line: Home prices have increased, selling closer to list price and moving quicker. High-end home sales are back for the first time in seven years!

Bottom Line: Home prices have increased, selling closer to list price and moving quicker. High-end home sales are back for the first time in seven years!

What does this mean for Sellers?

It depends if you need a loan or not. If you want to sell your home and buy a new home with cash, then time is on your side as prices will continue to increase. However, if you want to sell your home and buy a new home requiring a loan, time isn’t on your side. Your home price will increase with time but interest rates may/will also increase, so you may be better off selling sooner than later.

What does this mean for Buyers?

Buy now! We are at the point where both home prices and interest rates are climbing. So right now the timing is as good as it will get and time isn’t on your side.

What does this mean for Investors?

As home prices and interest rates both climb, capitalization rates will decrease. The supply of homes has been limited with little to no building in the last seven years. Rental rates have climbed and will continue on this path. Cost of borrowing and purchasing a home is also climbing. Right now is as good as it will get for investors.

What does this mean for Renters?

As stated above, the supply of rental homes has not increased in the last seven years while the demand for rental homes has increased. The growing population combined with the decreasing percent of ownership has increased demand for rental homes. We foresee rents continuing to increase and the majority of tenants will actually pay less in a monthly mortgage then they are paying now for rent. So again, now is the time to buy!

2014 Forecast: Home prices will continue increasing

Three factors will determine how the housing market fairs in 2014 and if home prices continue to climb

• Continue Quantitative Easing: The Federal Government has done a great job using “Quantitative Easing” to create a cheap supply of money, giving us historically low interest rates which in-turn have stabilized the economy and improved the housing market. Quantitative easing must continue until we achieve a healthier economy with high employment and higher wages. The soon-to-be Federal Reserve Chairwomen, Janet Yellen, has gone on record stating she will continue to stimulate the economy at current levels.

• Slow foreclosures: We have seen a drastic decrease in the number of bank-owned properties. Banks have written-off the majority of bad home loans but have taken little to no action on thousands of home loans that are currently in default. As prices increase, time is on the bank’s side and they can increase their efforts to refinance loans in default instead of pursuing the foreclose process. It’s critical that the banks continue their slow pace of foreclosing and not flood the market with excess inventory.

• Ease lending requirements: In the last few years, we have seen strict lending requirements that require higher credit scores, no discrepancies in credit history, and higher income. The approval process that has become grueling with endless documentation. Some of these new requirements are positive but in many cases we have overcompensated and standards need to be loosened. Unfortunately, we don’t see these standards changing in 2014 but they will need to be addressed to increase the numbers of homes sold in the future and achieve a full housing recovery.

If in 2014 we experience the same rate of recovery as 2013, we will soon be well on our way to a fully recovery in the real estate market in Southern Oregon.

Graham Farran is a broker with Expert Properties, located at 620 N. 5th Street in Jacksonville. Contact them at 541-899-2030 or online at www.expertprops.com.

Posted December 6, 2013